ADOPT TO INCOME

TAX SEASON 2020 :- “OLD TAX REGIME VS NEW TAX REGIME”:-

As

per the union budget 2020, announced by FM Nirmala Sitharam, it is clear that

tax payer has to choose between two options- Old tax regime and new tax regime.

Explaining the change, she said “an individual who is currently availing more

deductions and exemptions under income tax act may choose to avail and continue

to pay tax under old regime”

SYNOPSIS OF OLD TAX REGIME VS NEW TAX

REGIME :-

In new tax regime although rate of tax is lower, fix slabs but there is no

way to

reduce the taxes as one has to forego almost all the exemptions and

deductions and concessions.

In the Old Tax System – Though

the tax rates are higher but there are various deductions exemptions and

benefits if utilized properly can make a notable tax reduction.

WHICH ONE TO PICK UP ? :- confusion ?

Simple three steps to select Tax Regime :-

Step 1 :- One has to make a detailed calculation of all the

prospective investments, deductions and exemption for the whole year

Step 2 :- Make a tentative calculation of Income tax under both the schemes (Old Regime

and New Regime) Examples illustrated below.

Step 3 :- Compare

the burden of Tax and Make selection of Lesser One.

Only those taxpayers who do not have any income

through business are allowed to move to the new tax regime. Slab for individual

& HUF for FYR 2020-2021 is as below :-

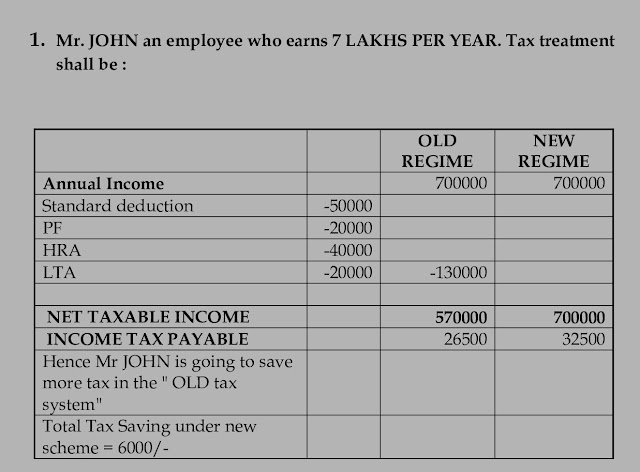

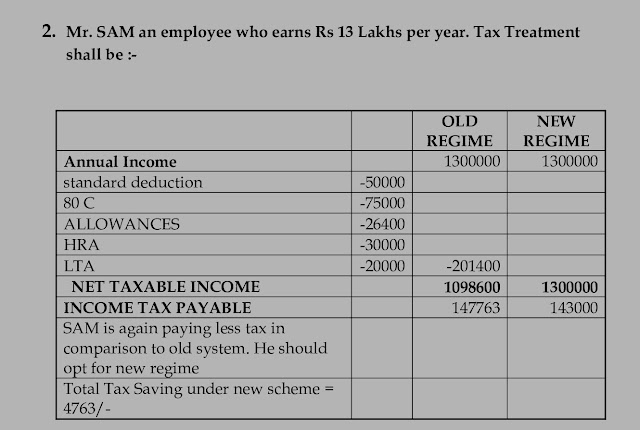

I have tried

to explain the Comparative analysis of both the regimes with the help of few

examples for easy understanding:-

On case to case basis the above tax calculation is to be made by every individual and proper selection of regime has to be made. For those opting or planning to opt for Old Tax Regime, I have tried to summaries tax planning guide/ tips as below :-

PERSONAL TAX

PLANNING GUIDE UNDER OLD TAX REGIME:

(FOR BOTH SALARY & NON SALARY ASSESSES- Tax Planning Guide 2020) :-

(FOR BOTH SALARY & NON SALARY ASSESSES- Tax Planning Guide 2020) :-

1. FULL UTILIZATION OF POPULAR TAX SAVING OPTIONS LISTED BELOW :

(SECTION 80 C + 80 CCC + 80 CCD)LIC, POLICY, STAMP DUTY ON HOUSE PURCHASE, EPF, PPF, NSC PRINCIPAL REPAYMENT OF HOUSING LOAN, KVP, TUITION FEES, ELSS MUTUAL FUND, TERM DEPOSIT/ FIXED DEPOSIT OF FIVE YEARS ETC.

2. GO FOR MEDICAL INSURANCE OF PARENTS (SECTION 80 D) AND CONSUME THE LIMIT.

3. FULL UTILIZATION OF BENEFIT LIKE STANDARD DEDUCTION, SECTION 24 B, LTC, HRA, PT, OTHER ALLOWANCES AS AVAILABLE UNDER OLD REGIME.

4. PLAN FOR NPS (NATIONAL PENSION SCHEME) AND CONSUME THE MAXIMUM LIMIT.

5. IF YOU ARE PLANNING TO BUY A RESIDENCE AND YOU HAVE OUTSTANDING PERSONAL LOANS, IT IS ALWAYS BENEFICIAL TO FINANCE AS MUCH OF PURCHASE PRICE AS POSSIBLE RESERVING YOUR OWN FUND TO MEET PERSONAL LOANS. THIS APPROACH WILL REDUCE THE EFFECTIVE INTEREST RATE AND WILL AVOID ADDITIONAL BORROWING EMERGENCY COST.

6. BOOK PROPER AND CALCULATED LTCG ON EQUITY INVESTMENT.

7. IF LTCG IN EQUITY INVESTMENTS EXCEEDS 1 LAKHS IN A FINANCIAL YEAR AMOUNT OVER THE THRESHOLD LIMIT SHALL BE CHARGEABLE TO INCOME TAX @ 10%. SO PLAN TO AVOID THIS BY BOOKING LTCG EVERY YEAR SUCH THAT GAIN DOES NOT EXCEED THRESHOLD LIMIT.

8. CONSIDER SELLING ASSETS IN TAXABLE ACCOUNTS THAT HAVE LOSSES AT THE END OF THE YEAR TO OFFSET THE CAPITAL GAIN TAX.

9. THE INVESTMENTS OPTIONS SHOULD BE THOROUGHLY EVALUATED FOR TAX BENEFIT AND YIELD ENHANCEMENT.

10. ENSURE A PROFESSIONAL MANAGEMENT OF YOUR FINANCIAL ASSETS

11. CONSULT YOUR TAX ADVISER TO ENSURE THAT YOU PROPERLY EVALUATE ALL SCENARIOS.

|

| TAX PLANNING GUIDE 2020 |

AFTER

UNDERSTANDING THE ABOVE TAX PLANNING TIPS START COLLECTING YOUR DATA AND GET READY FOR THE UPCOMING

INCOME TAX RETURN FILING SEASON.

GET YOURSELF READY WITH FOLLOWING DATA IN LOCK DOCKDOWN FOR UPCOMING INCOME TAX RETURN FILING FOR FYR 2019-2020 :-

GET YOURSELF READY WITH FOLLOWING DATA IN LOCK DOCKDOWN FOR UPCOMING INCOME TAX RETURN FILING FOR FYR 2019-2020 :-

- GET YOUR BANK ACCOUNT STATEMENT READY FOR FINANCIAL YEAR 2019-2020.

- DOWNLOAD YOUR FORM 26AS :- TRY AND GATHER TDS DEDUCTION DETAILS FROM FORM 26AS WHICH CAN BE EASILY DOWNLOADED FROM INCOME TAX SITE. DATA FOR QUARTER 1 , 2 AND 3 SHALL BE REFLECTED. QUARTER 4 DATA MAY NOT AVAILABLE DUE TO EXTENSION & LOCKDOWN.

- GATHER ALL THE PROOF OF YOUR INVESTMENTS DONE DURING FYR 2019-2020

- COLLECT ALL THE INFORMATION OF INCOME FROM YOUR BANK STATEMENT

- TRACE ANY ABNORMAL INCOME IF RECEIVED DURING THE FINANCIAL YEAR AND NOTE DOWN SEPARATELY IF ANY.

- DOWNLOAD INTEREST & PRINCIPAL STATEMENT FOR HOUSING LOAN REPAYMENT FROM BANK MOBILE APP OR INTERNET BANKING

- LINK YOUR ADHAR CARD WITH PAN CARD IF NOT DONE TILL DATE.

- DOWNLOAD THE SUMMARY STATEMENT OF MUTUAL FUND & SECURITY TRANSACTIONS FOR THE YEAR IF ANY

- DETAILS OF CAPITAL GAIN FROM SALE OF HOUSE/FLAT/OTHER CAPITAL ASSETS DURING THE YEAR – SALES CONSIDERATION RECEIVED, DATE OF RECEIPT, COST OF PURCHASE, DATE OF PURCHASE, COPY OF SALE DEED, INDEX 2 COPY

Conclusion

:-

“The only thing that hurts more than paying an income tax is not having to pay an Income Tax”

It is always advisable to Plan your finance and work your

plan, road maps with a clear vision and proceed positively for tomorrow belongs

to the people who prepare for it today.

ARTICLE

BY

CA.

JATIN RATHOR

(MOB

9595121481)

LINK

OF PREVIOUS ARTICLES : -

1.

INVESTMENT PLANNING

FOR FYR 2020 ( COVID -19 CRISIS AND ITS IMPACT ON EARNINGS . https://cajatinrathor1.blogspot.com/2020/04/investmentplanning-for-fyr-2020-covid.html

2.

“SIPs DURING SINKING MARKET AND WAY TO DEAL WITH

IT” – PAUSE, REDEEM OR CONTINUE IN VOLATILE MARKET?

3.

“TROUBLES” OF

BUSINESSMAN & WAY TO OVERCOME WITH OPTIMISM – POST LOCKDOWN AND GLOOM :-

4.

LOOKING

FOR STARTUP?? 14 HIGH GROWTH BUSINESSES

:- "POST LOCK DOWN & PLIGHT"

Please note :

1.

The above article is mere expression of opinion

of the writer and does not in any way bind the writer in any mode or manner whatsoever.

2.

For any

queries you can post a mail to the writer in the above mentioned email id.

Thanks for sharing this! Get a Tax Planning San Antonio from the top company based in Texas.

ReplyDelete